- With interest rate cuts on the horizon, investors may want to consider moving away from overweight allocations in cash in favour of longer-term return opportunities available now in bonds.

- In our view, a broadly diversified global bond portfolio with a medium-term duration profile can provide the best of both worlds: an attractive balance of risk and return that can help mitigate downside risk while capturing upside in an uneven market environment.

- The periods after interest rates peak have historically been beneficial for bondholders, with bonds outperforming cash in the post-peak periods of previous interest rate hiking cycles by central banks.

Many investors have preferred cash to bonds in recent years as they anticipated the interest rate hiking campaigns by central banks that began in 2022.

While holding cash has generally helped investors avoid the fluctuations in bond markets over the last few years, continuing to do so may wind up serving as an example of what worked in the past may not work so well in the future.

With rate hiking cycles now behind us, and rate cuts on the horizon in many markets, it’s time for investors to reconsider their allocations to cash, while also taking stock of how their fixed income allocations are invested across maturities.

The cash-bond trade-off in the current market

With bonds, investors can take advantage of current high levels of income and yield while also positioning their portfolios to capture the capital gains from potential future rate cuts, which are likely to cause existing bond prices to increase.

Those who stay parked in cash could not only miss out on the potential price gains in bonds when rates eventually start falling, they’d also likely see their cash rate start to fall too, as cash rates tend to quickly reflect any changes in interest rates.

Shifting expectations in bond markets

Part of the appeal of cash has been its apparent relative stability compared to bond markets, which have endured heightened levels of volatility in recent years — including a significant selloff earlier this year.

This year’s repricing came in the wake of last year’s end-of-year bond rally, when expectations of rate cuts in early 2024 had pushed up bond prices—resulting in global bond markets posting their best two-month returns in November and December 2023 since the global financial crisis1.

In January, the rally reversed, as markets adjusted their interest rate outlooks to be more in line with Vanguard’s long-held view that central banks in the UK and Europe are more likely to cut rates in the second half of 2024.

Despite the turbulence we’ve seen this year, it’s worth remembering that rate cuts still remain on the horizon – just not at the pace and magnitude that bond markets had initially expected. Bonds are still offering high levels of income bolstered by potential total return tailwinds from future rate cuts.

Post-peak periods have benefitted bond investors

Sometimes, the past can help guide us on our way forward. If we apply that principle to rate hiking cycles, historically, we see a strong pattern of bonds outperforming cash in the periods after central banks stopped raising rates2.

What if clients continue to prefer cash to bonds?

Because yield curves remain inverted, high rates on cash may make it tempting for clients to wait, but that’s not a riskless decision. When central banks cut policy rates, cash rates tend to follow. Clients may miss the moment and face reinvesting at much lower rates than they could get now on bonds. Additionally, they could wind up missing out on future capital gains in longer-duration diversified bond portfolios, which often experience strong price rises when interest rates decline.

It’s worth noting that even if cash has a higher starting yield than bonds, it doesn’t guarantee cash will outperform, even in the near term. In 2023, for example, returns on global bonds beat cash returns, even though cash yields were higher than bond yields at certain points of the year3. This was because the price appreciation in bond markets in late 2023 boosted bonds’ total returns above those on cash accounts.

Global bonds can offer a balance of risk and return in an uneven market

In a recent article, we explained why the inverted yield curve means traditional longer-dated government bonds may not currently offer attractive returns relative to the term risk involved.

In our view, a portfolio of global bonds offers an attractive balance of risk and return, with an intermediate-term duration profile that straddles the long and short ends of the yield curve — allowing them to perform in both rising and falling rate environments.

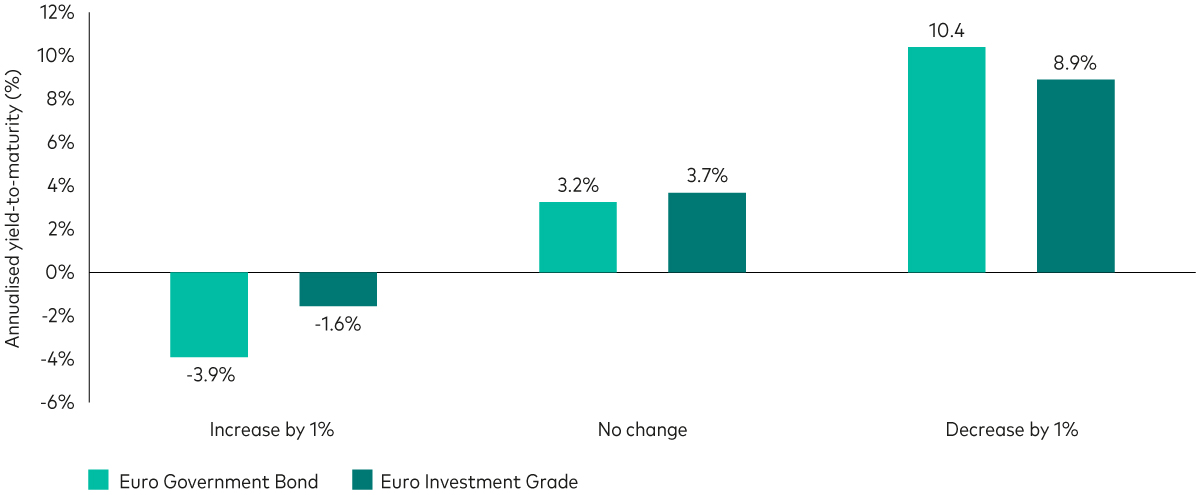

For example, the Bloomberg Euro Government Bond Index has a duration of 7.2 years – meaning if rates suddenly rose by one percentage point, the index could see a ~7.2% price decline. However, with a yield of 3.2%4, the index’s higher interest income component can help counter the fall in bond prices from such a move, leaving investors with an expected total loss of just 3.9%5 .

Conversely, if interest rates were to fall by one percentage point, the portfolio would be poised to see gains of 10.4%—providing a healthy boost in total returns for bond portfolios6.

Global bonds can add to upside, help cushion downside

Estimated annual returns of short-, intermediate- and long-duration bonds from a hypothetical 1% increase and decrease in interest rates

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Scenario assumes any interest rate changes occur at the beginning of the period and before any reinvestment of dividends. Scenario does not take convexity into account. This illustration is hypothetical and does not represent the return on any particular investment nor are rates of return guaranteed.

Notes: Proxies used: Euro-area investment-grade bonds: Bloomberg EUR Non-Government Float Adjusted Bond Index, which has a duration of 5.2 years and yield to maturity of 3.7%; Euro-area government bonds: Bloomberg Euro Government Float Adjusted Bond Index, which has a duration of 7.1 years and a yield to maturity of 3.2%.

Source: Bloomberg, with Vanguard calculations. Calculations in EUR, as at 31 May 2024.

Considerations for advisers

For most clients, it makes sense to consider moving away from overweight positions in cash towards a broad, high-quality bond exposure with a diversified allocation across the maturity spectrum.

Of course, it’s always best practice to align a client’s portfolio duration with their approximate investment horizon. For clients who plan to access their money within the next year or so, cash remains an appropriate option. But for those with longer time horizons, an allocation to high-quality, well-diversified fixed income can deliver strong risk-adjusted returns that can help your clients’ meet their longer-term goals.

1 Source: Vanguard.

2 Source: Vanguard. Based on the period from 2000 to 2024.

3 The Bloomberg Euro Government Float Adjusted Bond Index (EUR Hedged) outperformed the Barclays Benchmark Overnight EUR Cash Index by 1.36% for the 12-month period from 31 December 2022 to 31 December 2023. Source: Vanguard and Bloomberg.

4 Source: Vanguard and Bloomberg, based on the Bloomberg Euro Government Float Adjusted Bond Index (EUR Hedged), as at 31 May 2024. ‘Yield’ refers to the index’s yield-to-worst, which is the lowest potential annualised return an investor can earn on the bond if held to maturity, when all possible option scenarios are considered.

5 Source: Vanguard and Bloomberg. Based on hypothetical interest rate and return scenarios for the Bloomberg Euro Government Bond Index (EUR Hedged), as at 31 May 2024. Calculations in EUR.

6 Source: Vanguard and Bloomberg. Based on hypothetical return scenarios for the Bloomberg Euro Government Bond Index (EUR Hedged), as at 31 May 2024. Calculations in EUR.

Related funds

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL") (collectively, "Bloomberg"), or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices.

The products are not sponsored, endorsed, issued, sold or promoted by “Bloomberg.” Bloomberg makes no representation or warranty, express or implied, to the owners or purchasers of the products or any member of the public regarding the advisability of investing in securities generally or in the products particularly or the ability of the Bloomberg Indices to track general bond market performance. Bloomberg shall not pass on the legality or suitability of the products with respect to any person or entity. Bloomberg’s only relationship to Vanguard and the products are the licensing of the Bloomberg Indices which are determined, composed and calculated by BISL without regard to Vanguard or the products or any owners or purchasers of the products. Bloomberg has no obligation to take the needs of the products or the owners of the products into consideration in determining, composing or calculating the Bloomberg Indices. Bloomberg shall not be responsible for and has not participated in the determination of the timing of, prices at, or quantities of the products to be issued. Bloomberg shall not have any obligation or liability in connection with the administration, marketing or trading of the products.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe GmbH. All rights reserved.