- Over the past 130 years, technological innovation has been the primary driver of productivity growth and improvements in living standards.

- Such innovation includes includes general-purpose technologies (GPTs) such as electricity and the computer.

- Vanguard research suggests that AI has the potential to be a worthy successor to electricity as a general-purpose technology.

“If the AI impact approaches that of electricity, our base case is that productivity growth will offset demographic pressures, producing an economic and financial future that exceeds consensus expectations.”

Chief Economist and Head of Investment Strategy Group, Vanguard

If the impact of AI approaches that of electricity, our base case is that productivity growth will offset demographic pressures, producing an economic and financial future that exceeds consensus expectations.

Transformational tech

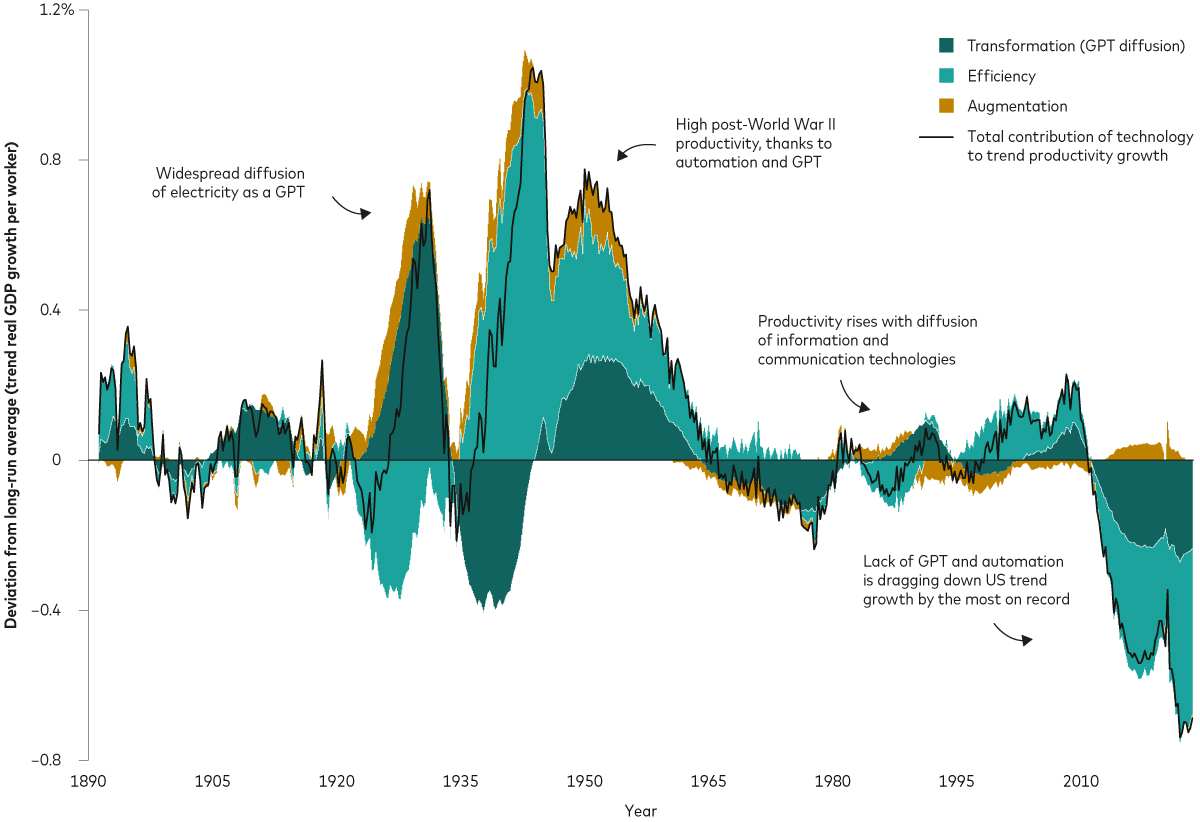

The chart below shows the importance of GPTs in driving periods of above-trend growth over the last 130 years.

Past performance is not a reliable indicator of future results.

Notes: The chart shows the historical contributions of transformation, efficiency and augmentation to the deviation of productivity growth from its long-term average from 30 June 1891 through to 30 September 2023. Transformation refers to general-purpose technologies (GPTs) that (eventually) unleash creative destruction through the economy. Efficiency refers to advances that raise GDP per worker, usually by automating away tasks previously performed by human labour. Augmentation refers to technological advances where humans benefit from machines, such as personal computers and power tools, raising productivity and trend employment. Our research quantifies the prospects of AI transforming the economy in the years ahead.

Source: Vanguard calculations, as of 30 May 2024.

This new research harnesses a uniquely long and rich dataset that captures historical shifts in megatrends, which have driven about 60% of the change in per capita GDP growth.

It finds that, among megatrends that also include demographics, fiscal deficits and globaliation, only technology has been a consistent, powerful driver of growth as well as inflation, stock market valuations and the US Federal Reserve’s nominal target for short-term interest rates.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe Gmbh. All rights reserved.