- The 60/40 model has shown resilience and long-term viability, despite experiencing a significant decline of about 16% in 2022.

- Historically, this portfolio strategy has delivered stable 10-year rolling returns, averaging an annualised return of 6.8% since 1997.

- Diversification across global equity and bond markets is key to the 60/40 portfolio’s consistency.

The 60/40 portfolio can be a wise choice for clients with a moderate risk tolerance.

Senior Investment Strategist, Vanguard

A globally diversified portfolio of 60% stocks and 40% bonds declined about 16% in 2022—a painful period for multi-asset investors that raised doubts about the viability of this strategy1. Some commentators even declared that the traditional 60/40 balanced approach, the old standby dead, was dead.

Fast-forward to September 2024: The global 60/40 portfolio is back in positive territory, with a 29.7% cumulative return since year-end 20222. Even accounting for 2022, the 10-year trailing annualised return of the 60/40 porfolio was 6.9% over the past decade, 10 basis points (0.01%) above its long-term average3.

Falling equity valuations and rising bond yields have given way to an improved return outlook for diversified 60/40 portfolios. While strong equity returns had an outsized impact on the 60/40 portfolio over the last decade and have driven valuations back to high levels, we expect to see more proportional contributions from each asset class over the next 10 years.

A solid long-term track record

The long-term track record of the 60/40 portfolio has been consistently strong. Though unusual, it’s not unprecedented to see stocks and bonds decline in tandem. Even so, the 60/40 portfolio can be a wise choice for clients with a moderate risk tolerance seeking broad diversification and a track record of solid long-term results.

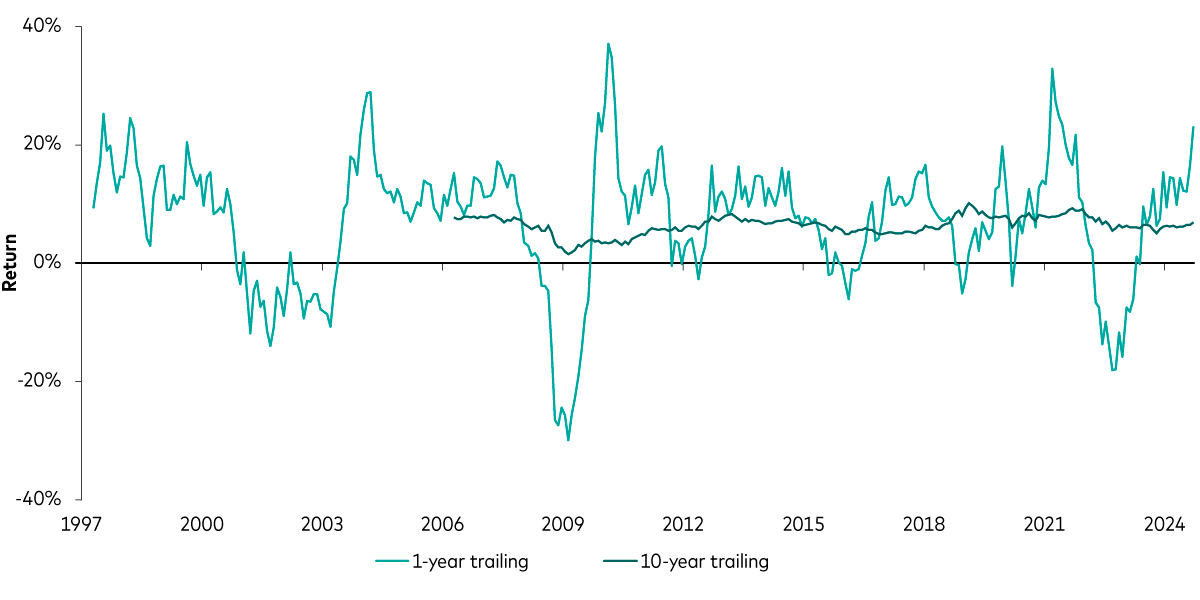

The strength of the 60/40 approach can be seen in the chart below, which plots the portfolio’s 10-year rolling returns dating back to 1997. While the strategy has had its good and bad years—returns ranged from +37% to –30% during the global financial crisis of 2007-2008—the 10-year returns have been much more stable. While our findings are in US dollar terms, we believe they remain relevant for global investors given the portfolio’s global diversification.

Returns of the 60/40 portfolio over time

Note: For information about the proxies used in the globally diversified 60/40 portfolio, please see index descriptions in footnote 1.

Source: Vanguard calculations, based on data from Standard & Poor’s, MSCI, and Bloomberg. Returns calculated in USD.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

To further quantify this, we ranked the historical periods by percentile and identified the interquartile range (the 25th and 75th percentiles). Since 1997, the interquartile range of 10-year returns remained relatively tight around its 6.8% average annualised return at 5.6% to 7.6%.

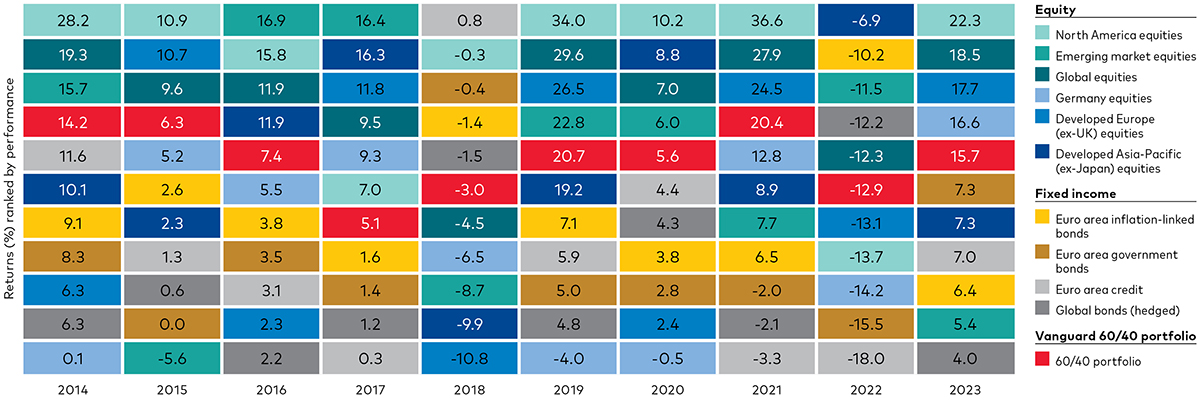

Diversification drives the 60/40 portfolio’s long-term consistency. By design and due to the global broad market exposure that yields diversification across and within asset classes, the strategy’s yearly performance is usually near the middle of ranked relative to the various segments of the global capital markets, as shown in the next chart, which compares the annual return of a hypothetical 60/40 portfolio with various asset classes.

Even in its worst years of absolute returns, such as 2022, the 60/40 portfolio rank relative to slices of the global capital markets was, predictably, about average. It is the relative consistency of these yearly returns over time that compounds into this competitive long-term track record.

Diversification is the key to the 60/40 portfolio’s success

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations, data from 1 January 2014 to 31 December 2023, using data from Bloomberg, Thomson Reuters Datastream and FactSet. Global equities represented by the FTSE All-World Index, North American equities by the FTSE World North America Index, Emerging market equities by the FTSE All-World Emerging Index, Developed Asia equities by the FTSE All World Developed Asia Pacific ex-Japan Index, Developed Europe equities represented by the FTSE All-world Developed Europe ex-UK Index, German equities represented by the FTSE Germany Value Index (price return only), Global bonds (hedged) by the Bloomberg Global Aggregate Index (hedged in EUR), Euro area credit represented by the Bloomberg Euro-Aggregate ex-Treasuries Index (EUR hedged), Euro area inflation-linked bonds represented by the Bloomberg Global Inflation-Linked Eurozone (EUR hedged). Performance shown is cumulative and denominated in EUR. It includes the reinvestment of all dividends and any capital gains distributions unless otherwise stated . The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Basis of fund performance NAV to NAV.

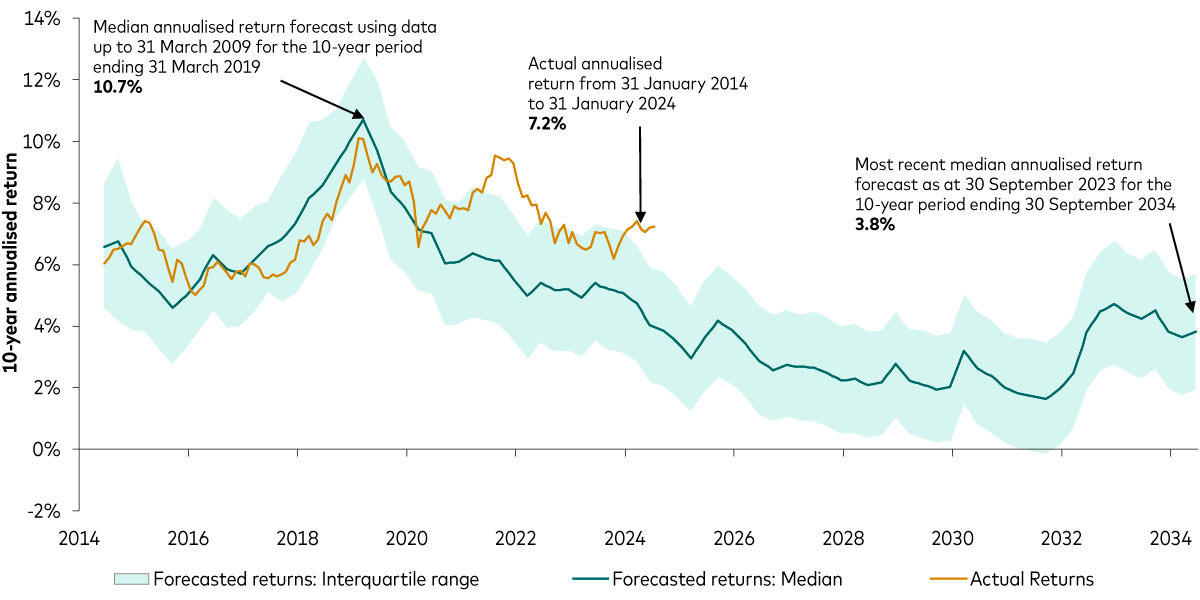

The 60/40 portfolio has been relatively in line with our forecasts

Another important aspect of the 60/40’s consistency has been its performance relative to our expectations in the Vanguard Capital Markets Model (VCMM). In the next chart, we plotted the interquartile range of expected returns from the VCMM dating back to 2014. The expected range of returns declined steadily as equities soared, but that all changed in 2022 when rising bond yields more than doubled the outlook for fixed income- returns.

The actual performance of the 60/40 portfolio was also remarkably steady, falling within the interquartile range of our forecast return the majority of the time. So, if anything, the 60/40 portfolio has been more consistent than one might expect. Diversification again was key to these results.

60/40 portfolio returns are now more in line with our view based on data available 10 years ago

Past performance is not a reliable indicator of future results. Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Source: Refinitiv as at 31 July 2024 and Vanguard calculations in EUR, as at 30 June 2024. Notes: This chart shows the actual 10-year annualised return of a 60/40 portfolio in EUR compared with the VCMM forecast made based on data available 10 years earlier. For example, the June 2014 data at the beginning of the chart show the actual return for the 10-year period between 30 June 2004 and 30 June 2014 (red line) compared with the 10-year return forecast made on 30 June 2004 (green line). After June 2024, the green line is extended to show how our forecasts made between 30 September 2014 and 30 June 2024 (ending between 30 September 2024 and 30 June 2034) are evolving. The interquartile range (green shaded area) represents the area between the 25th and 75th percentile of the return distribution. See the Appendix section for further details on asset classes.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are every quarter, between 30 June 2004 and 30 June 2024. Results from the model may vary with each use and over time.

It’s easy to get caught up in the noise and year-to-year absolute returns. That is why we encourage our clients to focus on what they can control—their goals, asset allocation, costs and discipline in implementing their investment strategy.

The strategic asset allocation and ‘steady as it goes’ results of a globally diversified balanced portfolio are a great starting place for long-term investors and that is as true today as any time in history. The 60/40 portfolio has been a remarkably consistent performer over the long-term, and with the tailwind of higher bond yields and a more balanced outlook, we see it as poised for another strong decade of results.

1 Vanguard calculations in USD, based on data from Standard & Poor’s, MSCI, and Bloomberg, for the period from 1 January 2022 until 31 December 2022. For the globally diversified 60/40 portfolio, we used the following proxies: for US stocks, a 36% weighting in the CRSP US Total Market Index; for non-US stocks, a 24% weighting in the FTSE Global All Cap ex US Index; for US bonds, a 28% weighting in the Bloomberg U.S. Aggregate Float Adjusted Bond Index; and for non-US bonds, a 12% weighting in the Bloomberg Global Aggregate Float Adjusted ex-USD Index. Past performance is not a guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

2 Vanguard calculations in USD, based on data from Standard & Poor’s, MSCI and Bloomberg, for the period from 30 December 2022 to 30 September 2024. For information about the proxies used in the globally diversified 60/40 portfolio, see footnote 1. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

3 Vanguard calculations in USD, based on data from Standard & Poor’s, MSCI and Bloomberg, for the period from 1 January 1997 until 30 September 2024. For the globally diversified 60/40 portfolio, we used the following proxies: for US stocks, a 36% weighting in the Dow Jones U.S. Total Stock Market Index (formerly known as the Dow Jones Wilshire 5000 Index) until 22 April 2005, the MSCI US Broad Market Index through June 2, 2013, and the CRSP US Total Market Index thereafter; for non-US stocks, a 24% weighting in the Total International Composite Index until 31 August 2006, the MSCI EAFE + Emerging Markets Index until 15 December 2010, the MSCI ACWI ex USA IMI Index until 2 June 2013, and the FTSE Global All Cap ex US Index thereafter; for US bonds, a 28% weighting in the Bloomberg U.S. Aggregate Float Adjusted Bond Index; and for non-US bonds, a 12% weighting in the Bloomberg Global Aggregate Float Adjusted ex-USD Index. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.