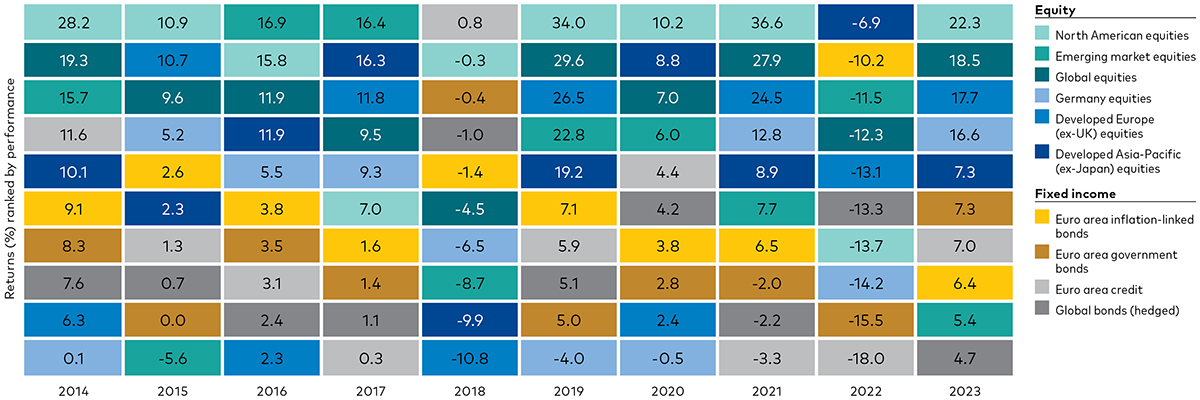

- Investors should be wary of chasing recent past performance and maintain a diversified exposure to global stock markets.

- The higher interest rate environment has raised the medium- and long-term outlook for global bond markets.

- Cash should not be considered a substitute for bonds in a multi-asset portfolio.

"Current economic conditions have made fixed income a more viable asset class that can grow over time and compound your returns for medium- to long-term savings needs."

President and Chief Investment Officer, Vanguard

After a period of relative market calm, market dynamics in the last few years have called into question the viability of traditional allocation models like 60% stocks/40% bonds and the conventional roles of asset classes. Cash delivered record returns, bonds fell in tandem with stocks in 2022 and US equities continue to outpace their counterparts in stock markets elsewhere.

The speed at which the landscape changed, as central banks attacked inflation with higher interest rates, serves as a strong reminder of why investors need to resist the temptation to chase performance and why portfolio diversification remains as important as ever.

Equities

US equities have contributed to much of the global market performance since the global financial crisis in 2008–2009. The low interest rate environment, rising stock valuations and high earnings in the US saw the US stock market return almost twice as much as global ex-US equities over the past decade.

US equities continue to be a strong performer, but the drivers of that outperformance over the last decade have likely sown the seeds for more muted performance over the coming one. With stretched valuations and a slowdown in earnings growth, we’re forecasting annualised returns of 1.8%–3.8%1 in the US equity market over the next decade for euro investors, based on the December running of the Vanguard Capital Markets Model (VCMM). Investors should be cautious with US equities, considering the expensive valuations and lower expected growth. By comparison, we anticipate higher average returns from global ex-US equities of 4.8%–6.8%2 annualised over the same period, owing to multidimensional growth opportunities given lower volatility, cheaper valuations and higher potential for growth outside the US.

Fixed income

Historically, bonds have served as a stabiliser for a portfolio because there’s usually less volatility risk in fixed income than in equities. Over the past decade or so, investors shied away from bonds in favour of cash and cash equivalents. But bonds and cash serve separate and distinct purposes. Over the long term, high-quality bond funds have tended to offer better diversification against stock volatility and higher yield potential than cash. While replacing bonds with cash may work in the short term, investors need to consider more than just yield if they want to design an all-weather portfolio.

Current economic conditions have made fixed income a more viable asset class that can grow over time and compound your returns for medium- to long-term savings needs. Global bond markets have repriced significantly over the last two years as interest rates increased, putting bond valuations close to fair. We expect both euro area aggregate bonds3 and global ex-euro area bonds (EUR hedged)4 to return a nominal annualised 1.9%–2.9% over the next decade. While we expect similar returns for euro area and global fixed income, it will remain important to diversify because global bonds can mitigate overall volatility and improve portfolio outcomes through lower correlations.

Cash

Investors should think of cash as the tool to manage liquidity risk—it can be a strategic allocation for day-to-day needs, for emergency savings, or for those with a very low risk tolerance. Cash should not be considered a substitute for stocks or bonds in any market environment, even in the current high interest rate environment, where investors have been able to get a real return on cash.

On the face of it, shifting your portfolio to cash might seem like a good idea in this environment: There is no risk in cash and you’re getting the same return you might from bonds—for now. But cash is limited in its ability to keep up with inflation and investing in cash means forgoing risk premium. Investors must also consider the durability of the yield, which is anchored to monetary policy. If central banks cut interest rates, the yield on cash decreases, and you’ll miss out on the income you would have earned if you had maintained your target bond allocation.

The current economic and market environment is primed to tempt investors to consider forgoing their strategy in order to chase returns. But across and within asset classes, we can’t account for everything, such as how an artificial intelligence-led productivity boom or geopolitical events could affect returns. Market leadership is not guaranteed, and chasing returns can leave investors exposed to unnecessary volatility and risk. Our research shows that a balanced mix of diversified assets, combined with a disciplined, cost-conscious approach to investing, can help improve investors’ chances of achieving their long-term investment goals, as long as they stay the course.

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations, data from 1 January 2014 to 31 December 2023, using data from Bloomberg, Thomson Reuters Datastream and FactSet. Global equities represented by the FTSE All-World Index, North American equities by the FTSE World North America Index, Emerging market equities by the FTSE All-World Emerging Index, Developed Asia equities by the FTSE All World Developed Asia Pacific ex-Japan Index, Developed Europe equities represented by the FTSE All-world Developed Europe ex-UK Index, German equities represented by the FTSE Germany Value Index (price return only), Global bonds (hedged) by the Bloomberg Global Aggregate Index (hedged in EUR), Euro area credit represented by the Bloomberg Euro-Aggregate ex-Treasuries Index (EUR hedged), Euro area inflation-linked bonds represented by the Bloomberg Global Inflation-Linked Eurozone (EUR hedged). Performance shown is cumulative and denominated in EUR. It includes the reinvestment of all dividends and any capital gains distributions unless otherwise stated . The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Basis of fund performance NAV to NAV.

1 Return expectations for US equities (EUR hedged) based on the MSCI USA Total Return Index (EUR), based on data as at 31 December 2023.

2 Return expectations for global ex-US equities based on the MSCI AC World ex USA Total Return (EUR) Index, based on data as at 31 December 2023.

3 Return expectations for euro area bonds based on the Bloomberg Euro-Aggregrate Bond Index, based on data as at 31 December 2023.

4 Return expectations for global ex-euro bonds (EUR hedged) based on the Bloomberg Global Aggregate ex Euro Bond Index (EUR Hedged), based on data as at 31 December 2023.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.