- Several emerging market sovereign issuers that defaulted on their debt have recently finalised restructuring packages that include favourable terms for existing debtholders.

- The new set of restructured instruments include innovative enhancements and payouts linked to the sovereign’s economic performance that could amplify returns to investors.

- For active fixed income investors with the experience and skills to navigate distressed sovereign issuers, the new restructured instruments could offer impressive return opportunities.

After a wave of emerging market (EM) sovereigns defaulted on their debt during the Covid-19 pandemic, several issuers are returning to the market with a new set of restructured bonds that are gaining the attention of active fixed income managers.

Since the start of 2024, four EM sovereign bond issuers have completed—or are soon to complete—restructuring negotiations that helped shore up their balance sheets and put them on more sustainable footing with their creditors.

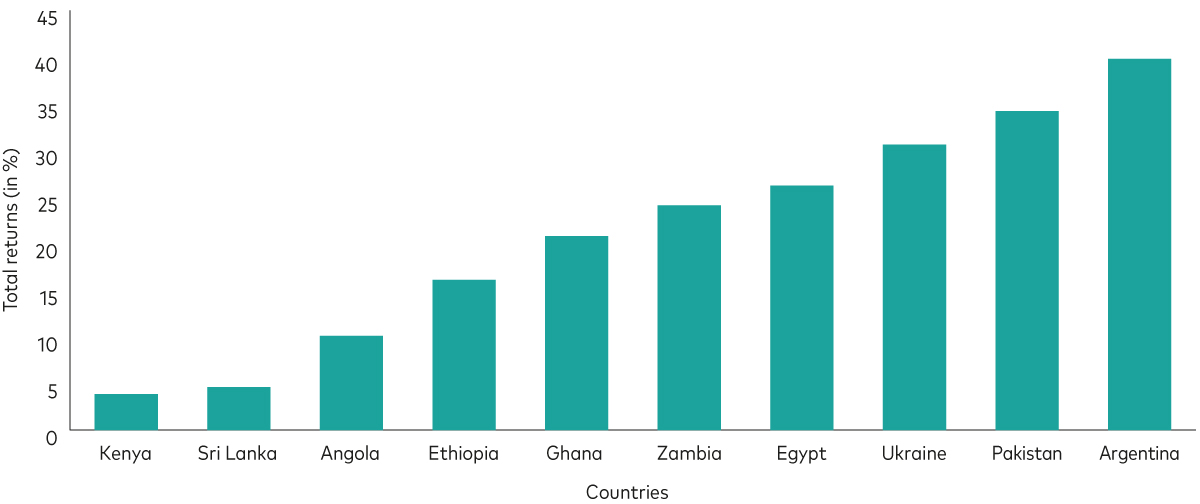

The restructured instruments are part of a new class of EM debt that has opened up in recent years, which has helped several sovereigns avoid default – while also delivering impressive returns for bond investors. Sri Lanka, Ghana and Zambia are among the issuers that have posted significant returns since restructuring their debt; the Zambian bonds, for example, have returned 24% this year, after finalising its restructuring terms in June1.

YTD total returns of distressed EM sovereign issuers

Source: Vanguard, using JP Morgan research. Calculations based on the total returns of individual countries’ sovereign debt, for the period 1 January 2024 to 31 August 2024. Returns in USD.

A compelling new market

Compared to the broader universe of EM debt, the value of sovereign defaults is small. Since December 2001, there have been 18 sovereign default events — accounting for an annual average of 3% of the total outstanding EM sovereign debt over the same time period2. The largest default was in Ukraine, where the ongoing geopolitical conflict led the country to default on some $20 billion of legacy sovereign debt since 2022.

Despite its high-risk connotations, investing in distressed sovereign debt isn’t as far out on the risk spectrum as many might believe. Post-default recovery rates for distressed EM sovereign issuers have averaged between 50 and 60 cents on the dollar, with some bonds recovering upwards of 70% or more of their original value3.

Innovative new bond features

Unlike the legacy bonds they replace, the new instruments come with a range of contingency provisions that, if triggered, could expedite and amplify their returns to investors.

The contingency triggers typically offer investors the potential for additional payouts linked to the sovereign meeting certain financial performance targets - which, if achieved, can result in bondholders receiving a higher coupon, faster amortisation or greater replenishment of the initial principal ‘haircut’4 – or a mix of these elements.

No two distressed situations are alike

There’s no one-size-fits-all approach to investing in distressed sovereign debt, as each case is unique. The lack of available resources and information within the sector adds to the challenge – but also creates mispricing opportunities.

For active managers with the appropriate expertise, research capabilities and risk management processes, investing in distressed sovereign debt can create opportunities.

At the highest level, our active EM fixed income team aims to take positions in distressed sovereign issuers that are nearing or in default, ideally before their restructurings have been finalised and their existing debt is trading at overly depressed levels.

When a sovereign enters default, the decline in value of its outstanding bonds tends to overreach, for a number of reasons. Many investor accounts, for example, have restrictions that prevent them from holding defaulted debt, forcing them to sell out and flood the market at the same time. Restructuring uncertainties can also weigh down sovereign bond values.

Once the restructuring terms have been agreed, the value of the sovereign’s existing bonds can rise significantly – generating outsized returns for investors who entered the position early enough, and at the right price.

Determining the ‘right price’

Determining the fair value of a sovereign issuer is a complex and multi-faceted process — but it’s arguably the most crucial driver of distressed debt returns and getting the most out of the asset class. At Vanguard, our dedicated team of credit research analysts run rigorous analyses on individual sovereign issuers, evaluating their debt sustainability along with cross-comparisons of various performing and non-performing sovereign discount rates, to gain a fundamental understanding of a sovereign’s post-default prospects and the fair value of its debt.

Restructuring uncertainties

Despite its broader benefits, the restructuring process is one of the most challenging elements to evaluate. Negotiations can be exhaustive and slow, and often result in unanticipated changes to the proposed restructuring terms. The range of stakeholders and creditors involved in the process can be extensive, adding to the uncertainty.

The IMF plays a key role in facilitating the negotiations, producing a debt sustainability analysis that acts as a starting point for negotiators to determine the level of debt relief needed. It also provides a credible baseline source for valuing the payouts linked to the newly restructured debt, often referred to as value recovery instruments (VRIs).

A risk-managed approach

Understanding the likelihood of a sovereign triggering their contingency provisions is another important element of our risk assessment process.

Trigger factors should be transparent, easy to track and not subject to potential manipulation. For example, with the new bonds issued by the Zambian government, the payouts are linked in part to the country’s output and price of copper, one of its chief exports – both of which are regularly published and can be monitored over time. The Ukrainian bonds are contingent on the country reaching certain GDP targets, which are also relatively simple to track.

Not all restructurings include VRIs with contingency provisions. In Ghana, for example, negotiators opted for a more traditional plain vanilla bond structure with just a coupon step-up, making the bonds easier to value – but lacking the upside potential offered by the VRIs.

Choosing the right active EM fixed income manager

As more nations resolve their defaults and their bonds regain status as index-eligible performing debt with a heightened likelihood of being upgraded, we expect demand for restructured instruments to increase.

Yet the idiosyncratic nature of the sector – including the complexity and variability of the restructured bonds – requires the experience of an active manager with the ability to identify which ones can really offer differentiated sources of alpha within the asset class. Our active fixed income team’s twin-process approach of combining forward-looking, fundamental analysis with careful risk management has resulted in a track record of consistent, long-term returns for our investors.

1 Source: Vanguard and JP Morgan. Returns are based on total returns for Zambia’s outstanding debt, for the period 1 January 2024 to 31 August 2024, calculated in USD.

2 Source: Vanguard and JP Morgan. Based on the cumulative average annual value of sovereign debt that was in default, as a percentage of the total EM debt outstanding, for the period 1 January 2001 to 31 August 2024. Total EM debt based on the JP Morgan Emerging Markets Government Bond Index over the same period.

3 Source: Vanguard using Morgan Stanley Research. Based on the recovery rates of defaulted EM sovereign debt issuers, for the period 1 January 2000 to 31 December 2023.

4 The ‘principal haircut’ refers to the value of a sovereign’s defaulted debt that is reduced as part of a broader debt restructuring package. It is typically computed as the percentage difference between the value of the sovereign’s original defaulted debt and the new restructured instruments.

Our active bond funds managed in-house

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.