- Voting day has come and gone in the US. Now is the time to maintain long-term perspective.

- Many factors can impact market performance, making it difficult to base investment decisions on a single factor like a presidential election.

- Investors should tune out the noise and not attempt to time the market, instead remaining focused on their longer-term investment goals.

Donald Trump has been called the winner of the 2024 US presidential election.

While investors may be tempted to adjust their portfolios in this type of market environment, no one knows how the markets will perform in the short term.

What we do know is that dozens of potential factors can impact the market, making it difficult to base investment decisions on a single factor like a presidential election. In fact, our research has found no meaningful difference between stock market returns in election and non-election years.

Timing the market is futile

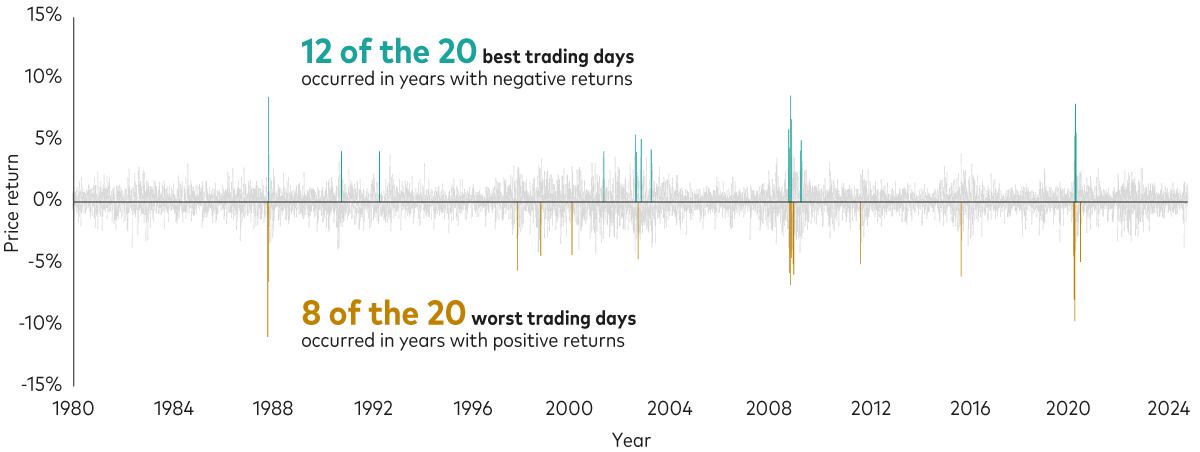

Often, timing the market can do more harm than good. Historically, the best and worst trading days have tended to occur close together. In the chart below, the gold bars, which represent the 20 worst trading days, look like mirror images of the green bars, which signify the best trading days. This makes the prospect of successfully timing the market almost impossible.

By trying to time the market, you run the risk of missing out on strong performance, which can seriously hamper long-term investment success.

The best and worst trading days happen close together

Past performance is not a reliable indicator of future results.

Sources: Vanguard calculations in EUR, based on data from Refinitiv, as at 1 October 2024.

Notes: The chart shows daily returns of the MSCI World Price Index from 1 January 1980 to 31 December 1987 and the MSCI AC World Price Index thereafter. The green bars highlight the 20 best trading days since 1 January 1980 and the gold bars highlight the 20 worst trading days since 1 January 1980. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

The success of stock markets over the long term isn’t driven by short-term events, but rather by economic growth, interest rates, productivity, innovation and dozens of other variables.

Focus on what you can control

We believe that investors are well-served by our four principles for investing success: have clear and appropriate investment goals; invest in a balanced portfolio of shares and bonds; minimise costs; and maintain perspective and long-term discipline. These principles are timeless – and are especially useful in times such as these.

By tuning out the noise and maintaining a long-term outlook, investors can keep progressing towards their financial goals.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.